How Does Fluxguard Help Insurance Companies?

Risk & compliance and legal teams operating in healthcare insurance rely on Fluxguard's website change detection technology to perform continuous surveillance of the regulatory landscape.

Reduce risk related to missing changes to laws that impact healthcare insurance.

Comprehensively collect healthcare insurance regulatory intel efficiently and cost-effectively.

Seamlessly turn regulatory insights into actions that decrease response time and increase overall revenue.

Stay abreast of changes from the Centers for Medicare & Medicaid Services, the Department of Health and Human Services, the Federal Trade Commission, state insurance regulators, and more.

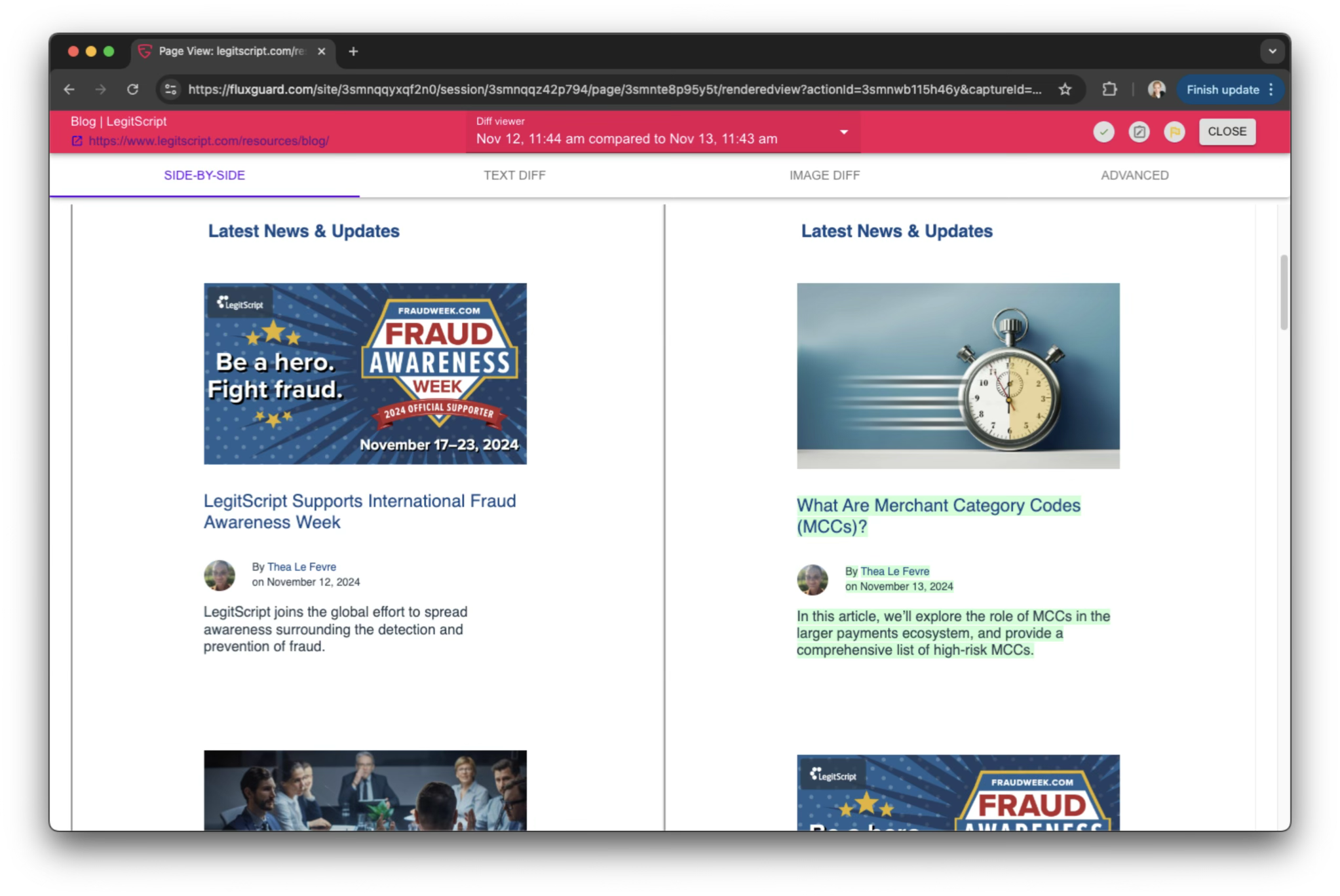

Track Regulatory Changes as They Happen

Stay abreast of changes to rules and regulations around healthcare insurance with accurate, timely, and comprehensive change detection and AI-powered alerts.

Why Use Fluxguard?

Healthcare insurance is regulated at many levels and varies from region to region. The rules and regulations that govern the industry are often buried within websites that require many clicks to navigate, and once located can be complex to understand. With Fluxguard you can:

Regulatory Compliance Technology Unlike Any Other

Engineered in partnership with the US Air Force, Fluxguard automates risk detection from subtle digital clues and resistant data.

Here’s How Fluxguard Works

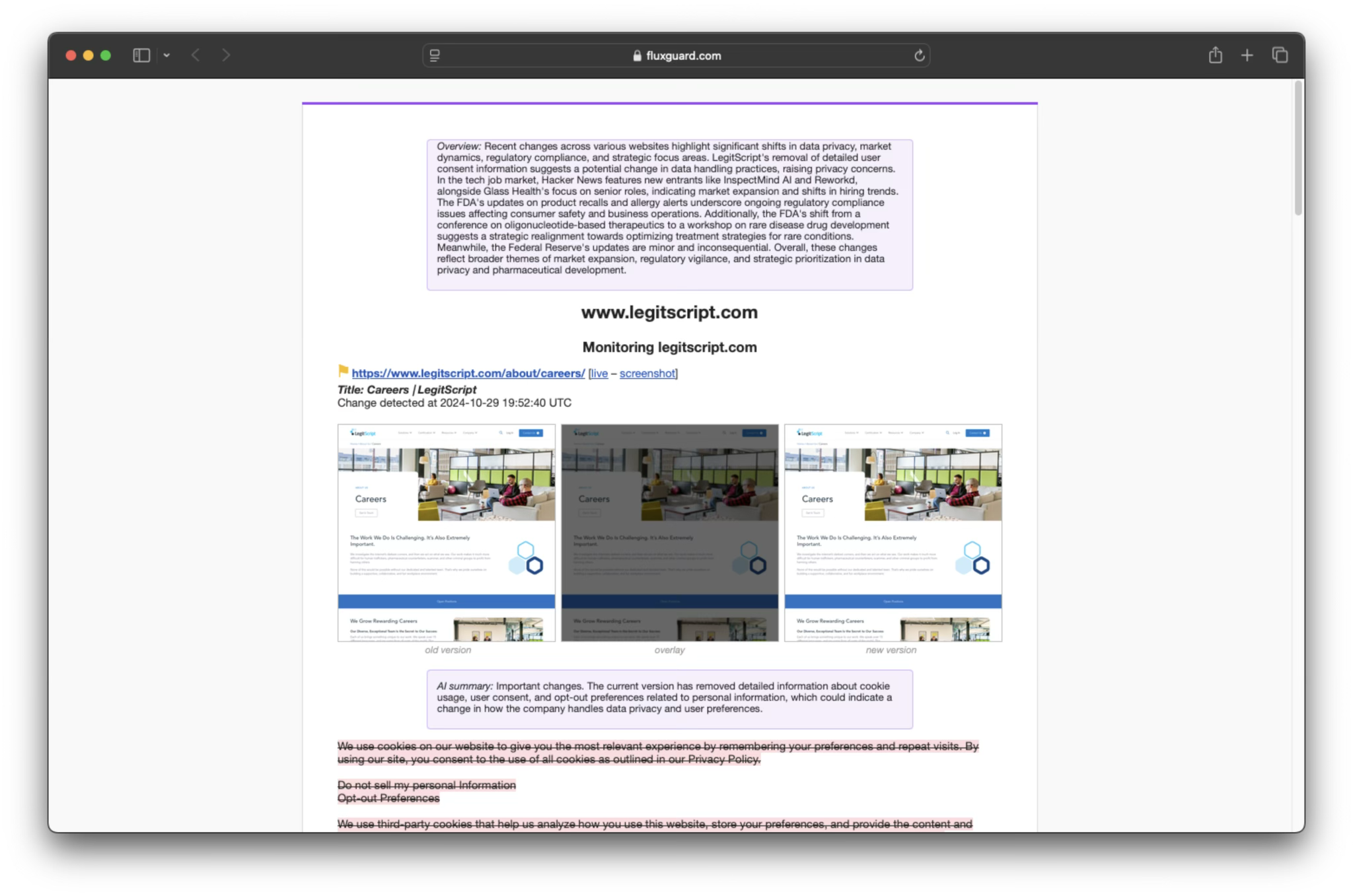

Crawls and Collects

Fluxguard first obtains data from often-complex web sources.

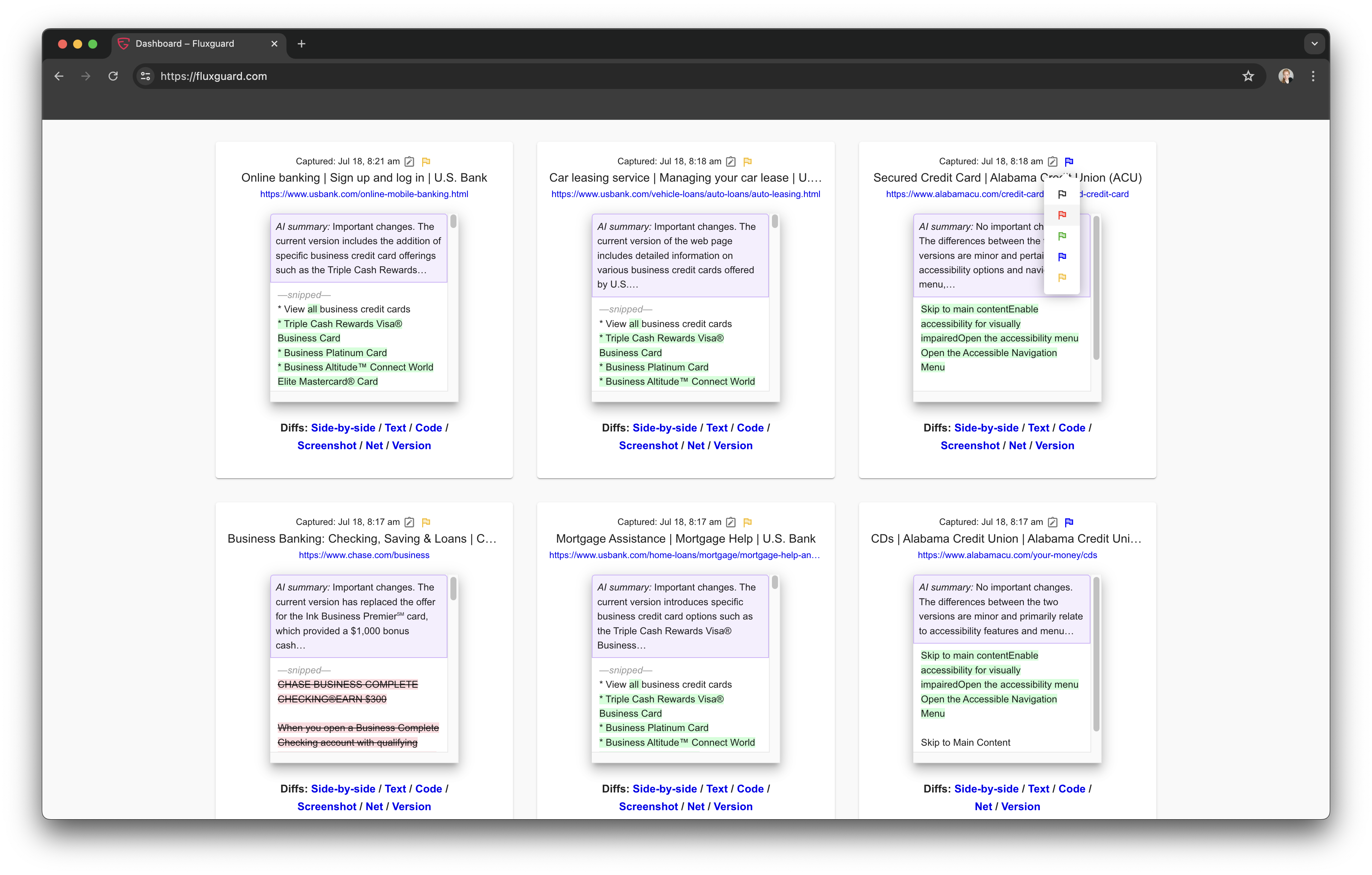

Evaluates and Prioritizes

Fluxguard then determines relevance to the customer’s rules and needs.

Transforms and Enriches

Next, Fluxguard uses change monitoring, ad hoc rules, and AI to tailor insights to each customer.

Integrates and Acts

Finally, Fluxguard dovetails results into your ecosystem when and where you need it.